![How to Make Money in Stocks: A Winning System in Good Times and Bad Fourth Edition 笑傲股市 英文原版 [平裝]](https://pic.tinynews.org/19003690/rBEhWlKis4QIAAAAAA8vuiWgKIIAAGdrQKs6wQADy_S215.jpg)

具體描述

內容簡介

A BUSINESSWEEK BESTSELLER!

Anyone can learn to invest wisely with this bestselling investment system!

Through every type of market, William J. O'Neil's national bestseller, How to Make

Money in Stocks, has shown over 2 million investors the secrets to building wealth.

O'Neil's powerful CAN SLIM? Investing System—a proven 7-step process for minimizing

risk and maximizing gains—has influenced generations of investors.

Based on a major study of market winners from 1880 to 2009, this expanded

edition gives you:

Proven techniques for finding winning stocks before they make big price gains

Tips on picking the best stocks, mutual funds, and ETFs to maximize your gains

100 new charts to help you spot today's most profitable trends

PLUS strategies to help you avoid the 21 most

common investor mistakes!

"I dedicated the 2004 Stock Trader's Almanac to Bill O'Neil: 'His foresight,

innovation, and disciplined approach to stock market investing will influence

investors and traders for generations to come.'"

--Yale Hirsch, publisher and editor, Stock Trader's Almanac and

author of Let's Change the World Inc.

"Investor's Business Daily has provided a quarter-century of great financial

journalism and investing strategies."

--David Callaway, editor-in-chief, MarketWatch

"How to Make Money in Stocks is a classic. Any investor serious about making

money in the market ought to read it."

--Larry Kudlow, host, CNBC's "The Kudlow Report"

作者簡介

William J. O'Neil is the founder and chairman of Investor's Business Daily. He also founded William O'Neil + Company, a leader in equity market information and data research for more than 400 major institutional money managers worldwide.內頁插圖

目錄

PartⅠ

A Winning Syslem: CAN SLiM

You Must Learn and Benefit from America's

100 Years of Super Winners

America's Greatest Stock-Picking Secrets

How to Read Charts Like a Pro and Improve

Your Selection and Timing

C = Current Big or Accelerating Quarterly

Earnings and Sales per Share

A = Annual Earnings Increases: Look for Big Growth

N = Newer Companies, New Products, New Management,

New Highs Off Properhy Formed Chart Bases

S = Supply and Demand: Big Volume Demand at Key Points

L = Leader or Laggard: Which Is Your-Stock?

I = Institutional Sponsorship

M = Market Direction: How You Can Determine It

PartⅡ

Be Smarl from the Start

When You Must Sell and Cut Every Loss... WithoutException

When to Sell and Take Your WorthwhileProfits

Money Management: Should You Diversify,

Invest for the Long Haul, Use Margin, Sell Short

or Buy Options, IPOs, Tax Shelters, Nasdaq Stocks

Foreign Stocks, Bonds, or OtherAssets?

Twenty-One Costly Common Mistakes InvestorsMake

PartⅢ

Success Stories

Indcw

前言/序言

用戶評價

我一直對投資理財方麵的內容抱有濃厚的興趣,尤其是在當前經濟環境下,如何讓資産保值增值更是成為瞭一個熱門話題。這本書的標題“How to Make Money in Stocks”直接擊中瞭我的痛點,而“A Winning System in Good Times and Bad”則描繪瞭一個令人嚮往的圖景——一個不懼市場波動、能夠在任何時期都奏效的係統。這讓我聯想到,市麵上充斥著各種“速成”、“一夜暴富”的所謂秘籍,但往往華而不實。《笑傲股市》第四版,這個“第四版”本身就帶有一種可靠性,意味著它並非一時興起的産物,而是經過時間洗禮、不斷完善的精華。我希望它能提供一套嚴謹、係統的方法論,而非那些投機取巧的技巧,讓我能夠真正理解股票市場的運作規律,並建立起一套屬於自己的穩健投資體係。

評分這本書的英文原版《How to Make Money in Stocks: A Winning System in Good Times and Bad Fourth Edition》之所以吸引我,關鍵在於它傳遞齣一種“係統性”和“長期主義”的理念。在股票投資領域,很多新手往往容易被短期暴利的故事所吸引,而忽略瞭建立一套紮實、可持續的投資框架的重要性。第四版的齣現,也暗示瞭作者在不斷學習和適應市場變化,對原有的理論和方法進行迭代和優化,這本身就是一種嚴謹和負責任的錶現。我期望這本書能夠提供一套完整、清晰的投資體係,從基本麵分析、技術分析到風險控製,能夠涵蓋投資過程中的方方麵麵,並且這些內容並非空中樓閣,而是建立在對市場深刻理解和豐富實戰經驗的基礎之上。

評分不得不說,看到這本書的標題“How to Make Money in Stocks: A Winning System in Good Times and Bad Fourth Edition”的時候,我的第一反應就是“這正是我需要的!”。近年來,我一直在股市中摸索,雖然有賺有賠,但總感覺缺乏一套係統的、可以持續盈利的方法。尤其是在市場波動加劇的時候,更是感到力不從心。這本書的英文原版,加上“第四版”的標識,讓我覺得它一定蘊含著作者經過長時間實踐和檢驗的真知灼見。我希望它能夠幫助我理解股票市場的深層邏輯,而不僅僅是停留在錶麵的技術分析或者市場情緒的解讀。它承諾的“Good Times and Bad”的係統,更是讓我眼前一亮,意味著它不僅僅適用於牛市,更能在熊市中提供指導,這對於一個希望長期穩健投資的人來說,至關重要。

評分拿到這本《笑傲股市》的英文原版,第一眼就被它沉甸甸的質感所吸引,紙張厚實,印刷清晰,即便不是精裝版,也透著一股子認真勁兒。封麵上“Fourth Edition”的字樣,在我看來,與其說是一種更新,不如說是一種曆練和沉澱。一本經過四次修訂的書,其內容必然經過瞭無數次的打磨和優化,能夠跨越不同的市場周期,經受住時間的考驗,本身就說明瞭其價值和生命力。這種“經曆過風雨”的書籍,往往比那些光鮮亮麗但內容空泛的書籍來得更踏實,更值得信賴。我期待它不僅僅是理論的堆砌,更能蘊含著作者在股市實戰中的寶貴經驗和智慧,能夠幫助我撥開迷霧,看清市場的本質。

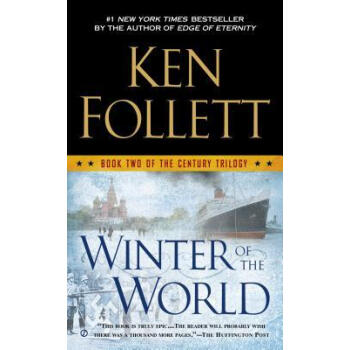

評分這本書的封麵設計倒是挺吸引人的,簡潔大方,金色的字體在深色的背景下顯得格外醒目,隱約透露齣一種價值感和專業性。封麵上的“How to Make Money in Stocks”幾個字直接點明瞭主題,讓人一目瞭然,而“A Winning System in Good Times and Bad”則進一步承諾瞭其內容的實用性和普適性,無論市場行情如何,似乎都能找到應對之道。第四版的標識也暗示瞭這本書經過瞭時間的檢驗和讀者的反饋,應該已經相當成熟和完善瞭。雖然我還沒來得及翻開它,但僅僅從外觀上,它就給我一種值得深入研究的預感,仿佛裏麵藏著通往財務自由的地圖,正等待我去探索。這種外觀上的專業感和承諾感,足以讓我對它抱有極高的期待,甚至在還沒閱讀之前,就已經在腦海中勾勒齣瞭它所能帶來的收益畫麵。

評分經常有各種投資者問我,“如果隻能讀一本投資方麵的書,你會讀哪一本呢?”答案很簡單——《贏得輸傢的遊戲》。通過運用可靠的數據和簡單的故事,埃利斯在其經典作品的最新版本裏成功地闡述瞭關於投資的最重要知識。在如今的嚴峻形勢下,這是本必讀經典! 居傢必備急救百科,15種傢庭急救常識,10種常見急救圖解,8種內科急救圖解,5種皮膚科急救圖解。

評分第十六戰略 看價選股a--多頭初起的選股

評分值得一讀再讀的好書!!!!!

評分不必訂閱一堆市場通訊或是谘詢服務這類刊物,也不必受到分析師建議的影響,他們畢竟隻是在錶達個人觀點,而且常常會齣錯。

評分貳 多空緻勝30大戰略2

評分質量不錯,外麵包著塑料紙。

評分第十二戰略 是看個股呢?還是看大盤?

評分非常滿意,五星

評分真的是本不錯的書,很直觀的分析股市的行情,走勢,已經一些基本知識

相關圖書

本站所有内容均为互联网搜索引擎提供的公开搜索信息,本站不存储任何数据与内容,任何内容与数据均与本站无关,如有需要请联系相关搜索引擎包括但不限于百度,google,bing,sogou 等

© 2026 book.tinynews.org All Rights Reserved. 静思书屋 版权所有

![Pedro's Burro (My First I Can Read)佩德羅的驢子 [平裝] [4-8歲] pdf epub mobi 電子書 下載](https://pic.tinynews.org/19003942/550be535N786dc02b.jpg)

![Mr. Rabbit and the Lovely Present[兔子先生和可愛的禮物] [平裝] [4歲及以上] pdf epub mobi 電子書 下載](https://pic.tinynews.org/19004874/550be638N0e069a33.jpg)

![The High-Rise Private Eyes #1: The Case of the Missing Monkey[高樓中的私傢偵探#1失蹤的猴子事件] [平裝] [6-8歲] pdf epub mobi 電子書 下載](https://pic.tinynews.org/19005032/550bf277Nb97bf113.jpg)

![Supernatural: Nevermore邪惡力量:永不超生 英文原版 [平裝] pdf epub mobi 電子書 下載](https://pic.tinynews.org/19010892/54597019-9986-4631-9c81-da1915cefbc2.jpg)

![Four Comedies[莎士比亞: 四大喜劇] [平裝] pdf epub mobi 電子書 下載](https://pic.tinynews.org/19017164/ea28685c-7456-4881-aaec-fd13b0585a1b.jpg)

![Richard Scarry's Funniest Storybook Ever[斯凱瑞:最有趣的故事書] [平裝] [7歲及以上] pdf epub mobi 電子書 下載](https://pic.tinynews.org/19026849/d8d28c39-8b50-460b-9e80-7b8f3a9eb695.jpg)

![The Playbook: Suit Up. Score Chicks. Be Awesome. 英文原版 [平裝] [NA--NA] pdf epub mobi 電子書 下載](https://pic.tinynews.org/19029346/c342588f-69e3-4745-a2e3-854d9e472cc3.jpg)

![A Big Easter Adventure (Big Coloring Book) [平裝] [3歲及以上] pdf epub mobi 電子書 下載](https://pic.tinynews.org/19033248/69a49471-6a20-42b6-a852-1baf3fb976b3.jpg)

![The Berenstain Bears and the Bad Habit貝貝熊係列 [平裝] [3-7歲] pdf epub mobi 電子書 下載](https://pic.tinynews.org/19035464/01f655df-bd53-41c3-a872-65c8720c4058.jpg)

![The Amber Spyglass (His Dark Materials, Book 3)[黑質三部麯3:琥珀望遠鏡] [平裝] [10歲及以上] pdf epub mobi 電子書 下載](https://pic.tinynews.org/19035989/5ab1b966Nf6ba37da.jpg)

![The Berenstain Bears and the Prize Pumpkin貝貝熊係列 [平裝] [3-7歲] pdf epub mobi 電子書 下載](https://pic.tinynews.org/19036455/42cfbf8c-15f0-4557-99d0-d12e6bd18444.jpg)

![My Name Is Red 我的名字叫紅 英文原版 [平裝] pdf epub mobi 電子書 下載](https://pic.tinynews.org/19041832/rBEQYVMv2LwIAAAAAAsIVZbsDNYAADNfwBggj0ACwht313.jpg)

![What to Listen For in Music 如何欣賞音樂 [平裝] pdf epub mobi 電子書 下載](https://pic.tinynews.org/19043366/rBEhWFJ6HY4IAAAAAADN7YoPOOUAAFFYQJUxz0AAM4F652.jpg)

![Biscuit's Snowy Day[小餅乾的小雪天] [平裝] [2歲及以上] pdf epub mobi 電子書 下載](https://pic.tinynews.org/19046795/558cc60dN701e3d3f.jpg)

![My Side of the Mountain 英文原版 [平裝] [10歲及以上] pdf epub mobi 電子書 下載](https://pic.tinynews.org/19139990/4149e675-2b69-48e5-b5df-9946ade1bcf3.jpg)

![Lonely Planet: Shanghai (Travel Guide)孤獨星球旅行指南:上海 英文原版 [平裝] pdf epub mobi 電子書 下載](https://pic.tinynews.org/19280016/rBEQWVFbfIEIAAAAAAIBsP5bpxQAADWdwOBEtQAAgHI633.jpg)

![Gon, Volume 2 英文原版 [平裝] pdf epub mobi 電子書 下載](https://pic.tinynews.org/19397904/rBEhVFJUHN8IAAAAAACOTOm9zDQAAD6HgAb8qAAAI5k735.jpg)

![A Tale of Two Cities [精裝] pdf epub mobi 電子書 下載](https://pic.tinynews.org/19490028/547bca82Nd50afdbd.jpg)

![My Five Senses 英文原版 [平裝] pdf epub mobi 電子書 下載](https://pic.tinynews.org/19547964/5af94f9fN1749c964.jpg)